- The General Agreements

- These mPAY terms and conditions are practical between Advanced mPAY Company Limited as a service provider and service user.

- The user has read the terms and conditions of the mPAY service, which specify the rights and duties of the service provider and the service user until fully understand the various details. Then, the user agrees to use the mPAY service via electronic means through the mobile phone system, including typing or selecting any messages and actions which cause the messages to display following the methods specified by the service provider via the mobile phone or other electronic devices as defined by the service provider. It can be considered that the user agrees to be bound and comply with these mPAY terms and conditions in all respects.

- The service provider has the right to refuse the service of mPAY to users according to the conditions specified in these mPAY terms and conditions or as the service provider deems appropriate without the need to give a reason.

- The Definition

- "The Service Provider" means Advanced mPAY Company Limited.

- "The user" means an individual who has agreed to use the mPAY by registering for the mPAY service.

- "mPAY Service" means the payment of products or services and financial transactions through the mobile payment system, the Internet or other electronic systems as specified by the Service Provider.

- " Product or Service Fee" means the product price, service charge, and public utility fee of the operator that has an agreement to appoint a service provider as a service provider for payment.

- "Username" means the mobile number of the user registered to use the mPAY service for users to identify themselves when using the mPAY.

- "Password" means the alphabet, characters, numbers, sounds, or other symbols of the service user's identity, which the service provider creates in electronic form, and the user creates newly. The user manages a password to demonstrate the relation with the username to use the mPAY service and to confirm whether the user is the electronic transactor by themselves or the electronic signer for that electronic transaction.

- "PIN" means the number created by the user for use as a personal identification code to manage the mPAY service. Besides, the user applies PIN to confirm whether the user is the electronic transactor by themselves or the electronic signer for that electronic transaction.

- "OTP Password" means a letter, character, number, or any other symbol created by the system of the service provider (One Time Password) and delivered via SMS service to the user's mobile number to register for mPAY service and/or to confirm whether the user is the electronic transactor by themselves or the electronic signer for that electronic transaction.

- "Payment Instrument (PI)" means the financial instrument of the user that can be used instead of cash to pay for products or services via mPAY, including:

- mPAY Wallet is an electronic wallet that maintains the value of electronic money (e-Money.) The service users can use electronic money as cash in the Wallet.

- Bank Account is an account created by banks that the user or the owner agrees to use as a financial instrument for payment of products and/or service fees by direct debit from the bank account.

- Credit Card is a credit card account that the user or the owner agrees to use as a financial instrument to pay for products and/or service fees by charging credit card accounts.

- "Mobile number" means the portable phone number used by the user to register for mPAY.

- "Agreement" means the terms and conditions of this mPAY service.

- mPAY Service Registration

- Users must register for mPAY service following the methods and procedures specified by the service provider.

- Users register for mPAY and enter the following information:

- Name - Surname

- ID Number / Passport Number*

- Date of birth

- Gender

- Contact Address

- Career

- Workplace

* In case the user is a foreigner, please enter 1) Passport number 2) Name of the country that issued the passport

- Rights to Use mPAY Service

- Users can register for mPAY service with only two numbers.

- Users register for mPAY service and enter full information following item 3. Users can top-up money in mPAY Wallet with a total value of up to 30,000 baht. A limit for payment of products or services and transfer-withdrawal service via mPAY Wallet, is not more than 90,000 baht/month. Besides, users can pay for products or services using a bank account and credit card following conditions as specified by the bank or the Credit card service provider.

- The service provider has the right to specify, adjust, or reduce the limit of mPAY usage per time by notifying the user in advance.

- Testimonials of users

- In the case that users register for mPAY services via electronic means through a mobile phone system, internet network, or automated system as specified by the service provider, the users confirm that all information and documents delivered to the service provider are the accurate information and a document taken from the original.

- In the case that users register mPAY by signing the document, the users confirm that the signature on the service request and/or in any materials used to register for the mPAY service is the valid signature of the user. Besides, the users certify that those supplementary documents were taken from the original, guarantee the correctness of any statements notified to service providers for mPAY registration.

- The users confirm having a name as a resistor or identifying themselves as a user and/or the owner of mobile number and use the number that has been registered to manage mPAY with the service provider.

- In the case that the users do not have a name as a resistor or identify themselves as a user and/or the owner of the mobile number and uses the number that has been registered to manage mPAY with the service provider, the users certify receiving consent from the resistor or person who identifies themselves as a user of that number to register the mPAY service with the service provider. If any damage occurs, the users agree to be responsible in all respects.

- In the case that the users do not have a name as a resistor or identify themselves as a user and/or the owner of the mobile number and uses the number that has been registered to manage mPAY with the service provider, the users certify receiving consent from the resistor or person who identifies themselves as a user of that number to register the mPAY service with the service provider. If any damage occurs, the users agree to be responsible in all respects.

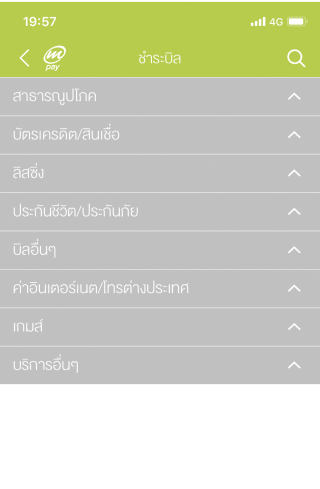

- Scope of service

- Users can use the mPAY service to pay for goods or services and select preferred financial instruments. Moreover, users are enabled to perform financial transactions via mPAY Wallets such as money transfer and withdrawal according to specified conditions.

- How to use the Payment Instrument

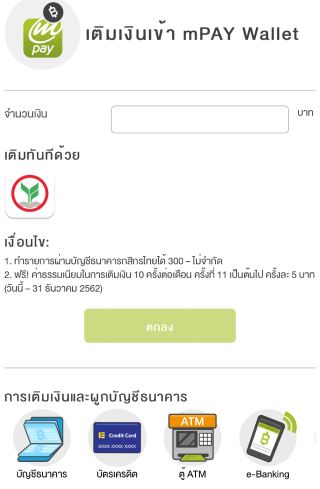

- mPAY Wallet

- When the users have registered for the mPAY service, the system will assign the mPAY Wallet as a financial instrument with that mobile number.

- Users can top-up in the mPAY Wallet by transferring cash or deducting money from bank accounts through various service channels, such as mPAY Application, ATM, Bank IVR (Telephone Banking), Internet Banking.

- Each mPAY Wallet top-up must not be less than the minimum amount, and the total amount cannot exceed the maximum amount specified by the service provider per number. This condition can be changed by notifying users in advance.

- The users can use the money in mPAY forever without an expiration date. This is until the mPAY service ends.

- Bank accounts and credit card accounts

- The users can take the bank account and/or credit card account of the user or of another person who agrees to debit money from the preferred account to link with the mPAY service. Furthermore, One mobile number can link to a maximum of 4 bank accounts and/or credit card accounts.

- Linking a bank account or credit card to use with the mPAY service, users must sign a letter of consent to debit a bank account or credit card or provide consent via electronic methods following the procedures specified by the banks, credit card issuers or service providers.

- mPAY Wallet

- Username, Password, PIN, OTP

- When registering for the mPAY service, the mPAY system requires the users to create a password and/or Personal Identification Number (PIN) by themselves

- Password creation must be at least eight characters and can be mixed letters, characters, and numbers.

- The PIN code must be only four digits of number without letters and characters.

- Password, PIN, and OTP are considered confidential to the users that must keep and conceal from others. If there are any transactions via the mPAY service arising from the use of the user's password, PIN, and OTP, whether by the users themselves or in the case that the users allow others to use a password, PIN, and OTP regardless of intention or negligence, it shall be considered that the mentioned transaction is correct, complete, and binding on the users as if the users were acting by themselves. If any damage occurs, the users agree to be responsible in all respects and cannot argue or demand the service provider to be liable for any damages.

- If the users use the password or PIN to process wrong transactions more than the number of times specified by the service provider (currently not more than three times), the mPAY system will temporarily suspend the use of the mPAY service. In case that the users still want to manage the mPAY service, the users must contact the service provider via 1175 (AIS Call Center) to request a new password or PIN.

- When registering for the mPAY service, the mPAY system requires the users to create a password and/or Personal Identification Number (PIN) by themselves

- The Fee

- The user agrees to pay the various fees due to the use of mPAY service at the rate that the service provider will inform in advance before making the transaction. The mPAY service fee rate is demonstrated in the table at the end of these terms and conditions.

- The service provider has the right to exempt or charge fees at a lower rate than specified in the promotion and service provision from time to time.

- The service provider reserves the right to define any additional fees or expenses in the service by informing the users in advance via WEBSITE /mpay

- mPAY Service Termination

- mPAY service will be terminated immediately in the following cases:

- Users notify to discontinue the use of mPAY service.

- Users notify to change of mobile number.

- Users notify to cancel mobile number usage.

- Users notify to transfer the authority of the owner of the mobile number.

- The mobile service provider cancels the mobile number registered for mPAY.

- Users do not use mPAY for six consecutive months

- mPAY service will be terminated immediately in the following cases:

- Denial of service, temporary service suspension, or termination of mPAY service transactions

- The service provider may refuse service or temporarily suspend service or terminate all or part of electronic transactions in the following cases:

- When it appears that the mPAY Wallet does not have a sufficient amount to pay for products, services, fees, or financial transactions.

- When it appears that the users have registered for mPAY service by entering incomplete information.

- เWhen it appears that the users use the mPAY service as a means of committing an offense as required by law or for illegally earning income or other benefits from another party or violating this agreement.

- When the service provider investigates that the users forge the document or use fake documents or show false statements and/or generate wrong information in using mPAY service.

- When the users are prosecuted in a civil or criminal case or a bankruptcy case or are a government official or a government agency was having an order to seize or attach property, or persons who are identified or accused or suspected of being an offender.

- When the users violate this agreement and/or the terms and conditions related to the mPAY service.

- The service provider considers that mPAY service may cause damage to users. The service provider will immediately suspend mPAY service for the financial security of the users. The service provider will notify the mPAY service suspension to the users via SMS

- The service provider has reasons to suspect that the users have committed an offense or attempted to commit a crime as required by law or take any action that may cause damage to the service provider or anyone, or have any other cause as specified by law.

- The service provider may refuse service or temporarily suspend service or terminate all or part of electronic transactions in the following cases:

- Withdrawing money from mPAY Wallet.

- Users who need to take money out of the mPAY Wallet can perform the money transfer transaction by transferring money in mPAY Wallet to another mobile number, withdrawal by transferring money to bank saving account and withdraw in cash. Users can transfer money through various channels specified by the service provider, such as mPAY Application, IVR.

- In case that the users need to withdraw money from the mPAY Wallet in cash, the service provider will take the amount into the bank account specified by the user as a financial instrument or another bank account that the users have requested for the service provider. The users will receive the money within three business days.

- The service provider has the right to charge the processing fee following item 12.1 at the rate specified by the service provider in the table at the end of these terms and conditions

- The remaining money in mPAY Wallet the mPAY service termination

- When the mPAY service is terminated for any reason, if it appears that there is still money remaining in the mPAY Wallet, the user can contact the number 1175 (AIS Call Center) to take out the money from mPAY Wallet. The service provider will deposit money into the bank account specified by the users as a financial instrument or another bank account of the users who informs the service provider to process within three business days. The users agree to provide a copy of the front page of the bank account book or a copy of the identification card or documents issued by the government to confirm the identity of the users to the service provider.

- In any case, the users have no right to charge any interest or compensation from the service provider.

- The service provider has the right to charge a processing fee under item 13.1 at the same rate as withdrawing money from the mPAY Wallet in cash at the rate specified in the table at the end of these terms and conditions.

- Personal information of users and investigation of mPAY usage

- The users agree to allow the service provider to collect, maintain, use, edit, send, transfer data, and disclose the personal information of the service user for the benefit of the service or to improve the mPAY service. In case that the users are registrants or identified themselves using AIS network mobile phone of Advanced Wireless Network Company Limited ("AWN.") The users agree with the service provider to request the personal information of the user with AWN and allow the AWN to disclose personal information such as name-surname, identification number, and address to the service provider.

- The users can check the usage information at mPAY Application and website /mpay or request from time to time by calling 1175 (AIS Call Center) to check the details of various payment transactions for not more than three months. The service provider will review and deliver the usage information only to the users with evidence demonstrating that they are the real mPAY registrants.

- The service provider has the right to charge the processing fee following item 14.2 at the rate specified in the table at the end of these terms and conditions.

- mPAY Service complaint submission

- When there are complaints regarding the use of mPAY, the users can contact by calling to 1175 (AIS Call Center) or sending the statement to the office of Advance mPAY Company Limited, 414 Phahonyothin Road, Samsen-Nai Sub-district, Phayathai District, Bangkok to report the complaints. The service provider will investigate and inform the progress, as well as explain the steps to solve the problem to the users within seven days from the date of receiving complaints.

- In case that the users have complaints about money in the mPAY Wallet, the service provider will perform the previous transaction investigation immediately. If it is found that no actual payment has been conducted, the service provider will refund the money to the users within 15 business days from the date of submission.

- In case that the users have complaints regarding the products or services, such as not receiving the products or services, the products are damaged or unqualified or not related to the description, the users need to contact the entrepreneur directly. The service providers are willing to cooperate in providing information and coordination for users to get solutions from the entrepreneur that sells products or provides services quickly.

- Termination of mPAY service by users

- Users have the right to terminate the use of mPAY service by calling 1175 (AIS Call Center).

- Termination of mPAY service by the service provider

- In the following cases, the service provider has the rights to terminate the service immediately:

- Death of the users

- Users use fake documents or show false information to register mPAY service.

- The mobile number registered for the mPAY service of the users is terminated by the mobile operator or service provider.

- Users do not pay fees as specified by the service provider.

- The service provider has the right to terminate the mPAY service by notifying the users in writing for at least 30 days in advance. However, the users can request to refund the remaining money in the mPAY Wallet according to the conditions specified in item 13.

- In the following cases, the service provider has the rights to terminate the service immediately:

- Modification of terms and conditions

- In case the service provider needs to amend the terms of this agreement, or there are any changes in the fees regarding the use of mPAY, the service provider will notify the users at least 30 days in advance via website //www. ais.co.th/mpay or various service channels of service providers.

- mPAY Service Rights and Duties Transfer

- The service provider reserves the right to transfer the rights and duties of this mPAY service to any other person, which will not affect the existing rights and obligations of the users on the transfer date without needing consent from users.

- Manuals and documents related to mPAYservice

- The users agree to accept that all manuals and documents related to the provision of mPAY services, instructions, or answers through mobile phones, which the user has complied with, both current and in the future, as part of these terms and conditions.

- AIS mPAY Mobile Payment Service

- Download PDF. Click!

- mPAY Fee Table

- Download PDF. Click!

- Privacy Policy

- Download PDF. Click!

- The collection, use, disclosure of data for the benefit of the users

- Download PDF. Click!